As we approach the end of 2024, it’s the perfect time to reflect on the year that was for Golden Visas – one of the most popular ways for investors and their families to secure long-term residency and future citizenship. With global events shaping the investment landscape and ongoing changes in legislation, 2024 has been a year of significant evolution and new changes. In this post, we’ll take a closer look at the major trends, successes, and lessons learned in the Golden Visa industry over the past year.

Increased Demand Amid Global Uncertainty

This year, global political tensions, economic uncertainty, and rising inflation pushed many high-net-worth individuals (HNWIs) to consider golden visas as a way to secure their futures. Countries offering residency by investment provided a strategic safety net against instability, whether due to economic downturns, geopolitical unrest, or the threat of higher taxes.

For investors seeking a hedge against these uncertainties, golden visa programs in stable countries became more attractive than ever. This led to a notable uptick in applications, especially from regions like the US and Asia. The flexibility offered by these programs, which allow investors to live, work, and travel freely within Europe or other regions, made them a key part of wealth and risk management strategies.

In 2024, major political shifts also influenced golden visa trends. For the first time in over a decade, the UK government changed hands from the Conservative Party to Labour, sparking interest among UK investors keen to make alternative residency plans. Concerns over the Labour Party’s proposed tax policies, such as the scrapping of the Non-Dom regime, led many to explore golden visas as a way to safeguard their wealth from what they viewed as potentially unfavourable tax changes. This shift significantly increased demand for residency programs in Europe, particularly in Portugal and Spain.

Similarly, more recently, La Vida saw a 2300% increase in interest from US investors following the results of the November presidential election. The uncertainty surrounding the future political landscape, including the potential for controversial policies under a second term of President Trump, drove many American HNWIs to seek secure residency options abroad. This surge in interest further demonstrates how political instability can drive individuals to diversify their wealth and secure a global foothold through golden visa programs and second passport investment.

Globally Changing Regulations and Policy Shifts

2024 has been a significant year for both golden visa and citizenship by investment program changes across the globe. Governments have introduced a series of reforms designed to enhance the sustainability, appeal, and credibility of these programs. From the scaling back of traditional real estate investment options to the introduction of new investment routes, these changes reflect a shift towards more strategic and impactful investment opportunities. Here’s a breakdown of some of the most notable updates:

Portugal: At the end of 2023, Portugal introduced major changes to its Golden Visa program. The widely popular real estate investment route was replaced with a €500,000 investment into qualifying funds. After a brief transition period, the new fund investment route quickly gained traction in 2024. The variety of fund options now available allows investors to choose from a range of sectors, including sustainable energy, agriculture, technology, and AI. Investors also have the flexibility to diversify their capital across multiple funds, making it easier to tailor their investments to specific interests or industries.

Greece: Greece implemented significant amendments to its Golden Visa program, which came into effect on August 31, 2024. The updated legislation introduced a dual-zone system for investment, categorizing the country into two tiers. Tier 1, with a €800,000 investment requirement, applies to high-demand areas such as Attica, Thessaloniki, Mykonos, Santorini, and islands with populations over 3,100. Tier 2, requiring a €400,000 investment, applies to other regions of Greece, offering a more affordable entry point for applicants while still benefiting from the program’s advantages. Notably, the program retains a €250,000 threshold for properties undergoing conversion from commercial to residential use or for the restoration of listed buildings, preserving the opportunity for investors to contribute to the preservation and revitalization of Greece’s heritage.

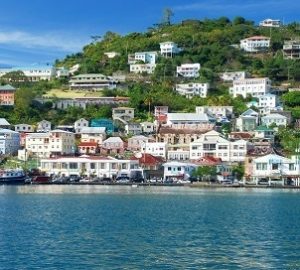

Caribbean: In the Caribbean, several countries including Grenada, St. Kitts, Dominica, St. Lucia, and Antigua made substantial changes to their Citizenship by Investment (CBI) programs. The most notable of these changes was the doubling of investment prices, raising the threshold for obtaining citizenship. Alongside these price increases, significant improvements were made to processing times and due diligence procedures, reinforcing the credibility and long-term viability of these programs. These reforms were designed to enhance program integrity and strengthen diplomatic relations with regions like the EU and the US.

The Growing Demand for Sustainable and Impact-Focused Investments

In 2024, there has been a marked increase in investors seeking golden visa programs that align with their personal values, especially in the areas of sustainability and eco-conscious development. Programs like Greece’s Golden Visa have seen growing interest, fueled by the rise of sustainable real estate investments that blend luxury with environmental responsibility. Additionally, investment funds in Portugal focusing on sustainability have gained traction, offering opportunities in sectors such as renewable energy, green technology, and eco-friendly infrastructure.

Eco-resorts, energy-efficient buildings, and sustainable developments have emerged as some of the most sought-after investment opportunities for those aiming to make a positive impact. For example, this luxury resort in Dominica, a leader in sustainable tourism, serves as a prime example of how investors can combine financial returns with a commitment to the environment. This shift is part of a larger trend toward socially responsible investing (SRI), which continues to gain momentum. Investors are increasingly looking for opportunities that offer not only strong financial returns but also contribute to the well-being of the environment and local communities.

Several Caribbean programs now offer both donation and real estate investment routes, with donations often directed toward meaningful projects such as building universities or funding hurricane protection initiatives. This approach allows investors to support critical infrastructure while securing their long-term residency or citizenship.

The Rise of Family-Oriented Residency and Citizenship Investment Programs

As families look to secure their futures, golden visa programs that allow applicants to include spouses, children, and even extended family members have become more popular. In 2024, there was an increasing trend of clients seeking these programs as part of their legacy planning, ensuring that multiple generations of their family could enjoy the benefits of residency and citizenship.

In particular, the flexibility of programs like Portugal’s Golden Visa, which offers family reunification options, continued to make it one of the most popular choices for those planning for the long term. This trend also extends to Caribbean CBI programs, where families can obtain citizenship, making it a smart choice for legacy planning and securing a Plan B for future generations.

A New Era of Younger, Wealthier Investors

In recent years, there has been a noticeable shift in the demographic of golden visa applicants. Historically, the typical investor seeking second citizenship or residency has been a male, over the age of 40. However, this trend has started to change, especially in the aftermath of the pandemic. The younger generation – particularly those between the ages of 30 and 40, has increasingly entered the market, driven by new sources of wealth and a desire for greater mobility.

Many of these younger investors have made their fortunes in sectors such as the stock market, technology, and social media, where entrepreneurship and digital innovation have enabled them to amass significant wealth at an earlier age. The rise of social influencers, successful tech startups, and savvy crypto and stock market investments have played a key role in fueling the wealth of this generation.

In addition, the pandemic accelerated shifts in work patterns, with remote working becoming more mainstream. This has led to a growing desire among younger individuals to secure the flexibility to live and work from different parts of the world. As a result, the concept of digital nomadism has become a common trend, with many younger investors looking to obtain second citizenship or residency to gain greater freedom to travel and work from anywhere.

This growing interest from a younger, tech-savvy demographic is expected to continue shaping the golden visa industry, with more investors in their late 20s, 30s and 40s seeking flexibility, security, and global mobility. These individuals are looking not just for financial returns, but for lifestyle advantages that offer the freedom to explore opportunities across borders – an attractive feature of golden visa programs.

A Crackdown on Unofficial Investment Routes and Financing Options

In 2024, the global investment migration industry saw a significant crackdown on unofficial investment routes and financed methods, which had been a growing concern for international agents and governments. Several companies, primarily based in the Middle East, had been offering discounted golden visa routes, working through loopholes in the system. These unofficial avenues, which involved financing structures that allowed investors to pay a lower upfront investment while still gaining residency rights, had been a point of contention for some time.

These risky, unethical and unregulated routes were a concern for legitimate agents and government bodies alike, as they undermined the integrity of CBI programs and posed significant risks for investors. In 2024, many governments took decisive action, with some even announcing that they would cancel passports obtained through these methods. This crackdown was aimed at restoring the credibility of the programs and ensuring that only genuine, compliant investors would benefit from CBI benefits.

As a result, serious investors are now acting more cautiously and are no longer being tempted by discounted routes, as they are increasingly aware of the risks that their citizenship or residency could be later canceled. More investors have turned to explore trustworthy options for their golden visa or CBI investments, choosing established, globally recognized companies like La Vida, who guarantee that they only offer compliant, reliable programs, approved by governments.

What We’ve Learned in 2024

As we reflect on 2024, it’s clear that the golden visa industry has undergone significant changes, responding to global events and evolving investor priorities. The trends and challenges we’ve seen this year provide valuable lessons for both current and prospective investors. Here are the key takeaways:

Flexibility and Diversification Are Essential: Investors increasingly value the ability to diversify their investments, whether across regions, sectors, or asset types. The growing availability of sustainable funds, along with a range of investment options, means there’s more flexibility than ever before in crafting personalized strategies. Additionally, family-friendly programs have become more important as investors seek opportunities that benefit multiple generations.

Sustainability is More Than a Trend: As socially responsible investing (SRI) continues to gain momentum, sustainable and eco-conscious investments are no longer just a niche interest. From green energy to sustainable real estate, investors are aligning their capital with environmental and social values. This shift will continue to shape golden visa programs and investment opportunities in the coming years.

Regulatory Changes Are Here to Stay: The evolution of golden visa regulations, from funding routes in Portugal to property investment changes in Greece, reflects the program’s adaptation to changing political and economic climates. Investors must remain vigilant and adaptable, ensuring they stay informed about shifting policies that could affect their investments. The crackdown on unofficial routes this year further emphasizes the importance of complying with government-approved, legitimate programs. And historically, like with most things in life, programme prices and costs rise almost every year, so the longer you leave it, the more expensive it will become.

Family-Focused Programs Will Continue to Be a Priority: The appeal of golden visa programs that offer family reunification options continues to grow. Investors are increasingly seeking programs that provide long-term security not only for themselves but for their families as well. Whether for legacy planning or securing a future outside of home countries, these programs will remain highly attractive to investors looking for comprehensive residency solutions.

As we close out 2024, it’s clear that golden visas are evolving in response to global shifts in politics, economics, and investor demands. With new opportunities and more changes ahead in 2025, now is the time for investors to assess their options, stay informed, and choose trustworthy, government-approved programs that meet their long-term goals. At La Vida, we remain committed to offering transparent, reliable, and compliant golden visa opportunities, ensuring our clients are well-positioned for success in the year ahead.